Power Generation vs Electricity Price: Which Is the King of Profit?

High Efficiency ≠ High Profit? The Hidden Traps Behind Power Generation

Under the current electricity market rules, solar farms must find a balance between power generation and electricity price to achieve higher overall returns. To secure higher prices, solar farms need to adjust their generation curves, producing less during midday and more in the morning and evening. Beyond relying on additional methods like energy storage, the solar panels themselves must also find ways to overcome these limitations. Ironically, most technological innovations in the PV industry focus on increasing module efficiency, which results in increased output during midday but lower prices. This puts greater pressure on investment firms, requiring them to consider both the levelized cost of energy (LCOE) and the characteristics of electricity pricing periods to maximize output during high-price times. Clearly, merely pursuing high conversion efficiency in modules is not sufficient; a multidimensional approach to investment is essential.

Solar Investment Must Consider "Quality-Price Ratio"

The previous strategy of solely maximizing power generation is no longer applicable. Instead, a more complex operational model has emerged that accounts for electricity pricing alongside generation capacity to maximize trading profits. This shift has also redefined the criteria for judging the merits of PV assets. In the past, high generation hours were the main indicator of asset quality. However, in the current market environment, the value of an asset is reflected more in its ability to generate electricity during high-priced hours, which reflects the time value of power. At the same time, the geographical location of new energy projects has become critical, especially those located in areas of relatively tight supply and demand, as they can capitalise on the spatial value of electricity.

This new value assessment system (i.e., time + space + flow) not only influences the operational strategies of existing assets but also has profound implications for future investment decisions. Investors must more comprehensively consider time and spatial factors when selecting new projects to ensure the asset's competitiveness and profitability in long-term operations. In summary, regional characteristics are becoming increasingly important. Solar farms must ensure both high generation capacity and the ability to achieve favorable prices during critical output periods.

How to Maximize Returns? Tracking High-Price Periods + Intelligent Scheduling

For Solar investment, solar farm selection should be considered is the power generation capacity in the high tariff hours, only pull high tariff hours of power generation, in order to effectively improve the project's comprehensive income. To cope with this problem, it can be optimised from the component power generation performance, structural innovation in two aspects.

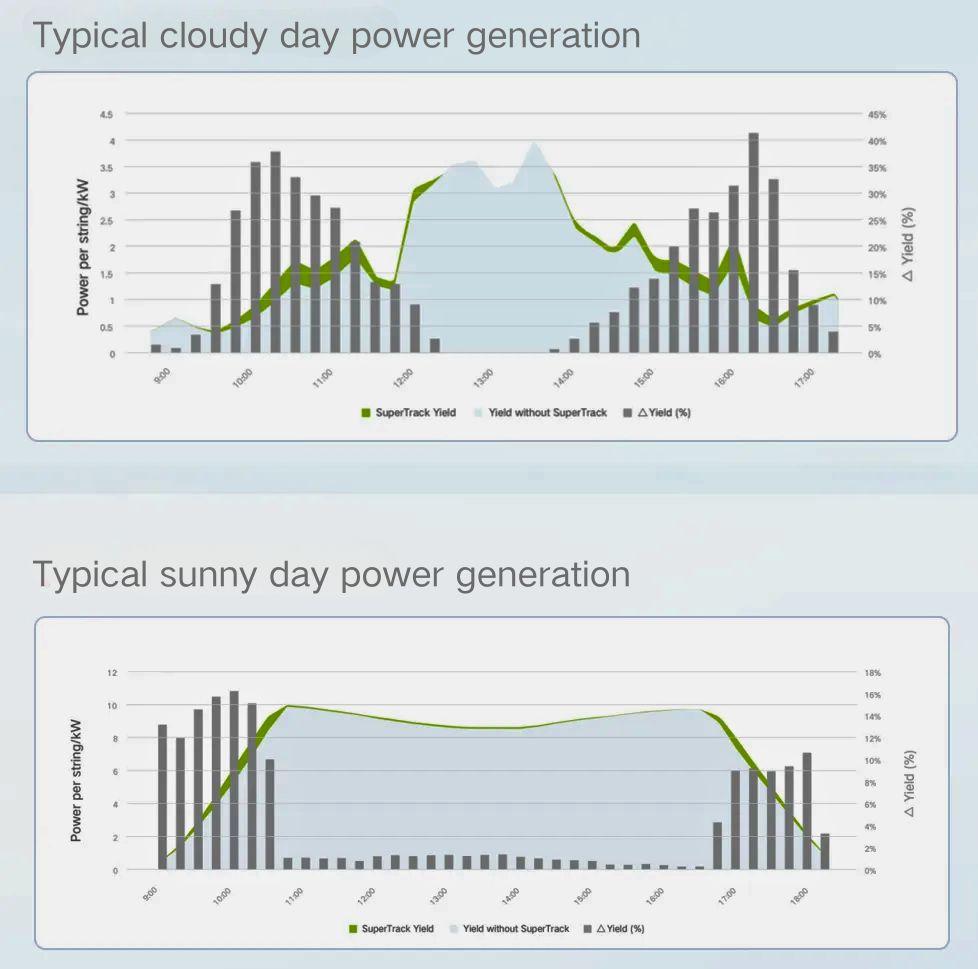

Globally, very few regions experience irradiation levels of 1000 W/m² for more than 10% of the time, with most areas seeing low irradiation levels. High prices typically align with these low-irradiation periods, helping mitigate issues in the spot market stemming from excessive midday generation, leading to reduced prices for solar farms. In terms of module performance, TOPCon modules demonstrate superior generation capabilities under low irradiation, making them better suited for current demands for tracking high prices (morning and evening). Another method to effectively track high-price periods involves using tracking mounts. Data shows that under typical cloudy and sunny conditions, using smart AI algorithms compared to astronomical tracking systems can yield power gains of up to 9.15% and 2.87%, respectively, with increased output during morning and evening periods surpassing the daily average.

The Ultimate Answer: How to Balance Power Generation & Electricity Price?

In the face of the dual challenges of power generation and electricity prices, seeking a balance between the two will be the ultimate goal of solar investment. Solar farm into the power market, will inevitably bring subversive impact on the existing revenue measurement model, further impact on the rules and methodology of power plant equipment selection, the direction of innovation in the industry should be from the amount of power * price of electricity from the comprehensive revenue, a single emphasis on the advanced nature of a particular indicator often can not achieve the goal of half the result with half the effort.