Vietnam Investment Pitfall Avoidance Guide

Amid a new cycle of geopolitical realignment, global supply chain restructuring, and rapid industrial and technological transformation, Vietnam has emerged as one of Southeast Asia’s fastest-growing emerging economies. Thanks to its strategic geographic location, abundant natural resources, a large and youthful population, accelerating industrial and consumer upgrades, and a vast domestic market, Vietnam has become an increasingly attractive destination for global capital.

In addition, Vietnam benefits from extensive free trade agreement (FTA) coverage, a relatively open and transparent foreign investment regime, and a political and cultural environment that is comparatively familiar to Chinese investors. These factors collectively position Vietnam as a prime destination in the ongoing wave of Chinese enterprises expanding overseas.

From the perspective of foreign investment attractiveness and trade vitality, statistics released by Vietnam’s Ministry of Planning and Investment (MPI) show that in January 2025 alone, newly approved, adjusted, and equity-based foreign direct investment (FDI) reached over USD 4.33 billion, representing a year-on-year increase of 48.6%. This highlights Vietnam’s rapidly rising status in the global investment landscape.

I. Vietnam’s Foreign Investment Regulatory Framework

At the central government level, foreign investment in Vietnam is supervised by the Foreign Investment Agency under the Ministry of Planning and Investment (MPI). At the provincial and municipal levels, responsibility lies with local Departments of Planning and Investment (DPI).

Vietnam’s legal system consists primarily of international treaties and domestic laws, including statutes, decrees, official letters, and circulars.

1. International Treaties

As of April 2024, Vietnam has signed 16 free trade agreements, including modern, high-standard FTAs such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the EU–Vietnam Free Trade Agreement (EVFTA), and the Regional Comprehensive Economic Partnership (RCEP), all of which are under active implementation with tariff-reduction commitments.

For Chinese investors planning to enter the Vietnamese market, particular attention should be paid to the following agreements in order to fully leverage market access and trade facilitation benefits:

ASEAN–China Free Trade Agreement (ACFTA)

The foundational Framework Agreement on Comprehensive Economic Cooperation between ASEAN and China entered into force on July 1, 2003.

Regional Comprehensive Economic Partnership (RCEP)

Effective from January 1, 2022.

ASEAN–Hong Kong Free Trade Agreement (AHKFTA) and the Investment Agreement

The Investment Agreement entered into force for Vietnam and Hong Kong on June 17, 2019.

2. Domestic Foreign Investment Legislation

Key domestic laws governing foreign investment in Vietnam include:

·Law on Investment (Law No. 61/2020/QH14) – effective January 1, 2021

·Law on Planning (Law No. 21/2017/QH14) – effective January 1, 2019

·Law on Enterprises (Law No. 59/2020/QH14) – effective January 1, 2021

·Civil Code (Law No. 91/2015/QH13) and Code of Civil Procedure (Law No. 92/2015/QH13), among others

Similar to China, Vietnam adopts a “negative list” approach for foreign investment access. On March 26, 2021, the government issued Decree No. 31/2021/ND-CP, which promulgated the List of Sectors Restricted from Foreign Investment, identifying 25 prohibited sectors and 59 conditional sectors.

Chinese investors are advised to thoroughly understand and comply with these regulations and to structure their investments prudently.

II. Foreign Direct Investment Entry Routes and Key Procedures in Vietnam

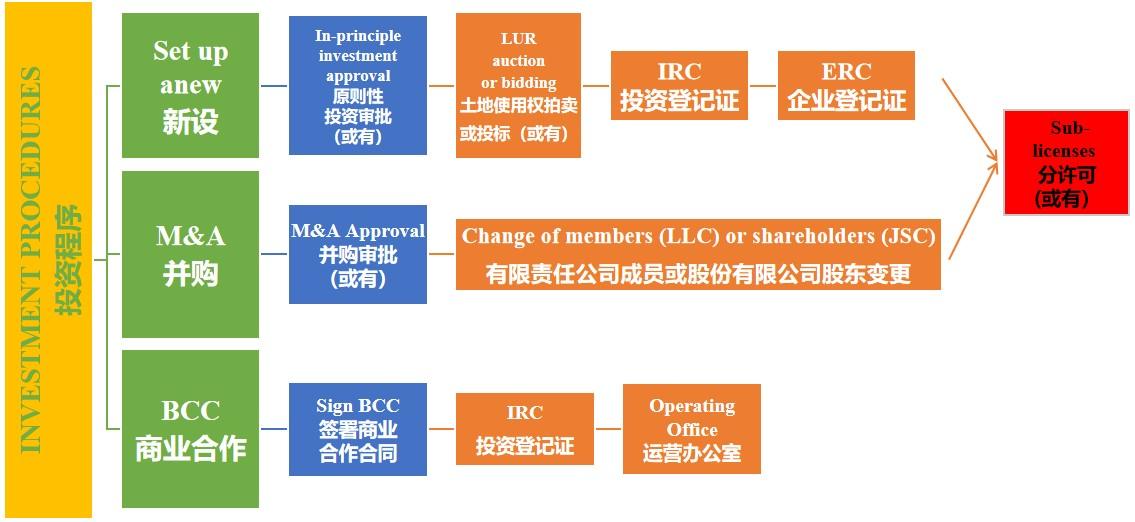

Foreign investors typically enter Vietnam through one of the following three FDI pathways:

Each investment route involves specific approval procedures, licensing requirements, and compliance steps, which should be carefully planned in advance.

III. Key Investment Sectors in Vietnam

1. Manufacturing

Manufacturing remains the largest and most concentrated sector for Chinese investment in Vietnam, particularly in industries such as electronics, computers, new building materials, textiles and garments, home appliances, furniture, footwear, and machinery.

Under the Law on Investment, foreign access to manufacturing is relatively liberal. In addition to the Investment Registration Certificate (IRC), Enterprise Registration Certificate (ERC), and, where applicable, Land Use Rights Certificate, manufacturing projects may also require:construction permits, environmental impact approvals, fire safety approvals, depending on the specific nature of the project.

2. Renewable Energy

In July 2024, the Vietnamese government issued Decree No. 80/2024/ND-CP on Direct Power Purchase Agreements (DPPA). This regulation allows renewable energy generators to sell electricity directly to large power consumers with monthly consumption exceeding 200,000 kWh.

This policy marks a significant step toward breaking the traditional monopoly of the state-owned electricity utility and enhances the commercial viability of renewable energy projects.

Renewable energy investments typically progress through the following stages: project preparation,project development, project implementation, operation and maintenance.

A thorough understanding of these stages helps investors secure all required regulatory approvals and ensure full legal compliance.

3. Logistics

Logistics is classified as a restricted foreign investment sector, with different foreign ownership caps across sub-sectors:

·Maritime transport services: Joint venture required; foreign ownership capped at 49%

·Inland waterway transport: Joint venture required; foreign ownership capped at 49%

·Container handling services (excluding airport services): Joint venture required; foreign ownership capped at 50%

·Warehousing and storage services: No restriction

·Freight forwarding services: No restriction

·Air transport services: Joint venture required; foreign ownership capped at 34%; foreign ownership in Vietnamese institutional shareholders capped at 49%

·Road transport services: Joint venture required; foreign ownership capped at 51%

4. Data Centers

Data center services involve providing data processing, storage, and retrieval via telecommunications networks. Infrastructure typically includes buildings, sites, cabling systems, computing systems, power supply systems, and auxiliary facilities.

Under Vietnamese law, data center services fall within the scope of telecommunications services and are governed by the Telecommunications Law and related regulations.

From January 2025, Vietnam permits 100% foreign ownership in data center businesses. However, traditional telecom services (such as internet access services) remain subject to market entry restrictions.

Partner selection rules also apply:

·Non-facility-based telecom services: No restrictions on partner selection

·Facility-based telecom services: Cooperation is limited to licensed Vietnamese telecom service providers

IV. Key Challenges for Foreign Investors in Vietnam

Vietnam offers abundant investment opportunities, but its regulations in areas such as employment relationships, tax treatment, and dispute resolution may pose certain challenges for foreign investors.

In terms of employment relationships, Vietnam’s Labor Code emphasizes the protection of employee rights and imposes relatively strict conditions for employee dismissal by enterprises. Generally, labor relations may only be terminated under circumstances such as expiration of the labor contract, completion of agreed work tasks, mutual agreement between both parties, or unilateral termination by the employee or employer (subject to specific conditions).

Regarding taxation, foreign investors in Vietnam are subject to corporate income tax (CIT), personal income tax (PIT), value-added tax (VAT), and import-export tax (IET), among others. It is worth noting that Vietnam offers preferential CIT incentives for projects located in economic zones or high-tech zones, manufacturing projects with an investment capital of at least 6 trillion VND, and software development projects. Vietnam implements a self-assessment and self-declaration mechanism for tax incentives, with annual finalization. Enterprises eligible for tax incentives are not required to submit applications to the tax authorities; instead, they self-calculate and apply the incentives in accordance with tax laws. While the self-assessment policy provides considerable convenience, if the competent authorities determine that an enterprise does not meet the conditions for tax incentives, the enterprise will be required to pay the outstanding taxes along with late payment penalties, and may face fines ranging from one to five times the amount of underpaid or unpaid taxes.

CIT (Corporate Income Tax):

Standard rate: 20%

Special rates: 32% to 50% (applies to oil, gas, and rare resource sectors, e.g., petroleum exploration and extraction activities: gold exploration and extraction (50%); precious minerals and rare natural resources (40%))

PIT (Personal Income Tax):

Progressive rates ranging from 5% to 35% (5% for annual taxable income below approximately 17,040 RMB; 35% for annual taxable income above approximately 272,640 RMB, with increments in 5% stages in between)

IET (Import-Export Tax):

Rates from 0% to 50%

VAT (Value-Added Tax):

Rates: 0%, 5%, and 10%